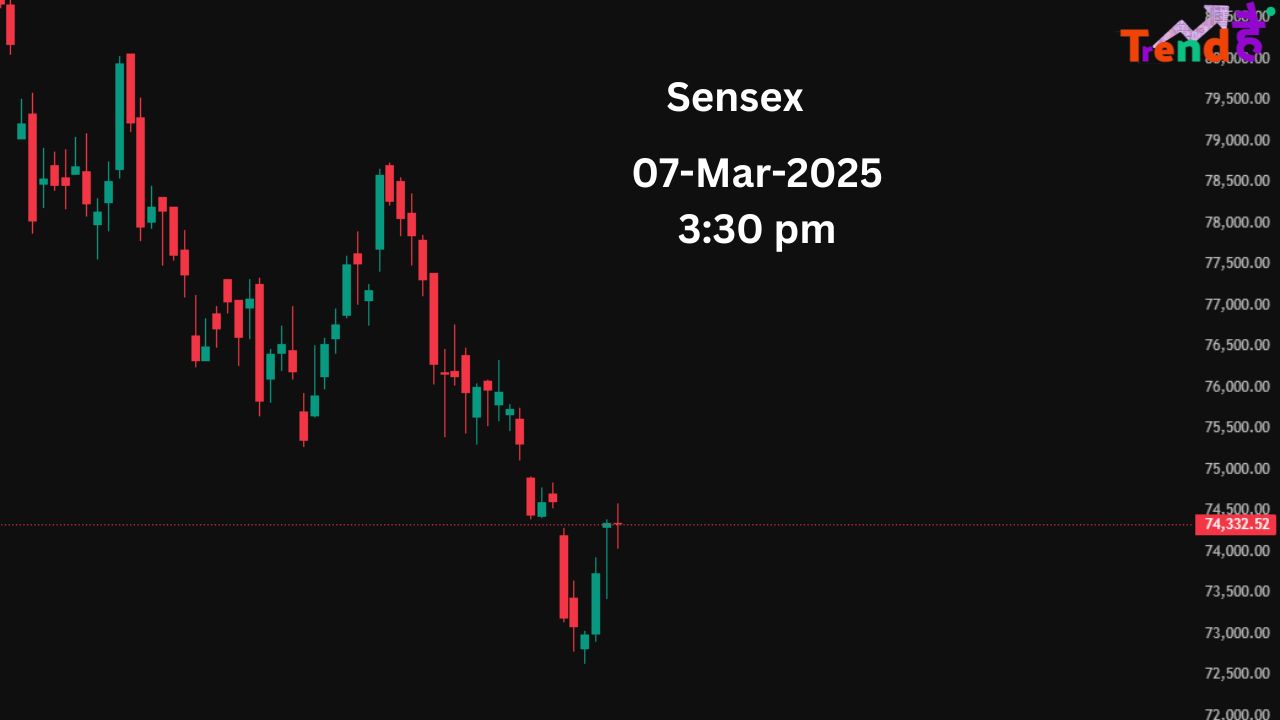

Date: 07-mar-2025

The Indian stock market closed slightly lower on March 7, 2025, as concerns over U.S. tariffs and global economic data kept investors cautious. The Sensex dropped by 0.32% to 74,108.62, while the Nifty 50 declined by 0.29% to 22,481.75.

While IT stocks faced selling pressure, automobile stocks managed to stay resilient. The market movement was also influenced by global economic concerns, upcoming U.S. jobs data, and comments from Federal Reserve Chair Jerome Powell.

Please note that this screenshots of both Nifty 50 and Sensex is of the daily timeframe.

The performance across different sectors was mixed, with IT stocks dragging the market down while automobile stocks showed resilience.

The U.S. administration recently announced tariff relaxations on Mexico and Canada. While this helped global market sentiment, concerns over new trade restrictions still linger.

Investors are awaiting key U.S. employment data and comments from Federal Reserve Chair Jerome Powell, which could impact interest rate decisions.

Market analysts believe that the short-term trend remains volatile, but long-term fundamentals remain strong. With inflation under control and government initiatives supporting industries, the Indian market may remain attractive for investors.

The Indian stock market closed lower on March 7, 2025, as global trade uncertainties, IT sector weakness, and cautious investor sentiment influenced trading. While the market remains volatile in the short term, positive long-term fundamentals support a strong recovery.

Investors should closely monitor global economic updates and upcoming policy decisions to navigate the markets efficiently.

Date: 07-Mar-2025

Indian Stock Market Opens in Red: Sensex Drops 200 Points, Nifty Below Key Level The Indian stock...

Date: 08-Mar-2025

Gold Rate Today – 8 March 2025: Check 22K & 24K Prices in India Gold Prices in Major Cities of In...